Introduction to Forex Trading

Forex trading, also known as foreign exchange trading, is the process of buying and selling currencies on the global financial market. Unlike stocks or bonds, Forex trading involves the relative value of two currencies against each other, commonly referred to as currency pairs. Each pair consists of a base currency and a quote currency, and traders speculate on whether the base currency will strengthen or weaken relative to the quote currency.

The fundamental principle behind Forex trading is simple: if a trader expects the value of a currency to increase, they buy it (going long), and if they anticipate a decrease, they sell it (going short). The profitability hinges on the movement of exchange rates, which are influenced by a multitude of factors including economic indicators, geopolitical events, and market sentiment.

One of the distinguishing features of the Forex market is its size and liquidity. It is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. This enormous scale provides significant opportunities for traders, but also requires an understanding of the dynamics that drive currency movements.

Forex trading contrasts with other types of trading and investing in several critical ways. Unlike the stock market, Forex operates 24 hours a day, five days a week, offering more flexibility for traders. Additionally, it involves leverage, which means traders can control larger positions with a relatively small amount of capital. While leverage can magnify profits, it also increases potential losses, making risk management a crucial aspect of Forex trading.

Understanding exchange rates is essential in Forex trading. Exchange rates denote the value of one currency in terms of another, and they fluctuate continuously due to market conditions. Traders must stay informed about economic news and trends, as these factors can significantly impact currency values and exchange rates.

The global Forex market plays a pivotal role in the world economy by facilitating international trade and investment. It enables businesses and governments to convert one currency into another, thus supporting global economic activities and stability. With this foundational knowledge of Forex trading, readers can better understand the more complex elements explored in subsequent sections of this guide.

Setting Up Your Forex Trading Account

Setting up a Forex trading account is a crucial first step towards entering the world of currency trading. The journey begins with selecting a reputable broker. A broker acts as an intermediary between traders and the forex market, facilitating transactions. When choosing a broker, ensure they are regulated by a recognized financial authority, which guarantees a certain level of transparency and security. Popular regulatory bodies include the Financial Conduct Authority (FCA) in the UK, the Commodity Futures Trading Commission (CFTC) in the US, and the Australian Securities and Investments Commission (ASIC).

Once a broker is selected, the next decision involves choosing the right type of account. Forex brokers typically offer different types of accounts, catering to both beginners and experienced traders. Standard accounts, mini accounts, and micro accounts are common, differing primarily in the size of the trades that can be executed and the initial deposit requirements. Beginners usually opt for micro or mini accounts as they allow one to trade smaller amounts of currency, thereby reducing risk exposure.

Setting up an account necessitates providing certain documentation. The broker will generally require proof of identity and proof of address. Valid government-issued identification, such as a passport or driver’s license, usually satisfies the proof of identity requirement, while utility bills or bank statements can serve as proof of address. These measures are essential for compliance with anti-money laundering (AML) regulations.

Depositing funds into the trading account marks the next step. Brokers commonly offer various deposit methods, including bank transfers, credit/debit cards, and electronic payment systems like PayPal or Skrill. Choose a method that best aligns with your convenience and financial planning. It’s prudent to start with an amount you are comfortable with and can afford to lose, given the inherent risks in trading.

Before diving into live trading, it’s highly recommended to utilize a demo account. These simulated accounts mirror live trading environments without financial risks, allowing beginners to practice trading strategies and familiarize themselves with the trading platform. Utilizing a demo account can help build confidence and refine skills, thus paving the way for a more informed and strategic entry into the live market.

Essential Forex Trading Strategies and Tools

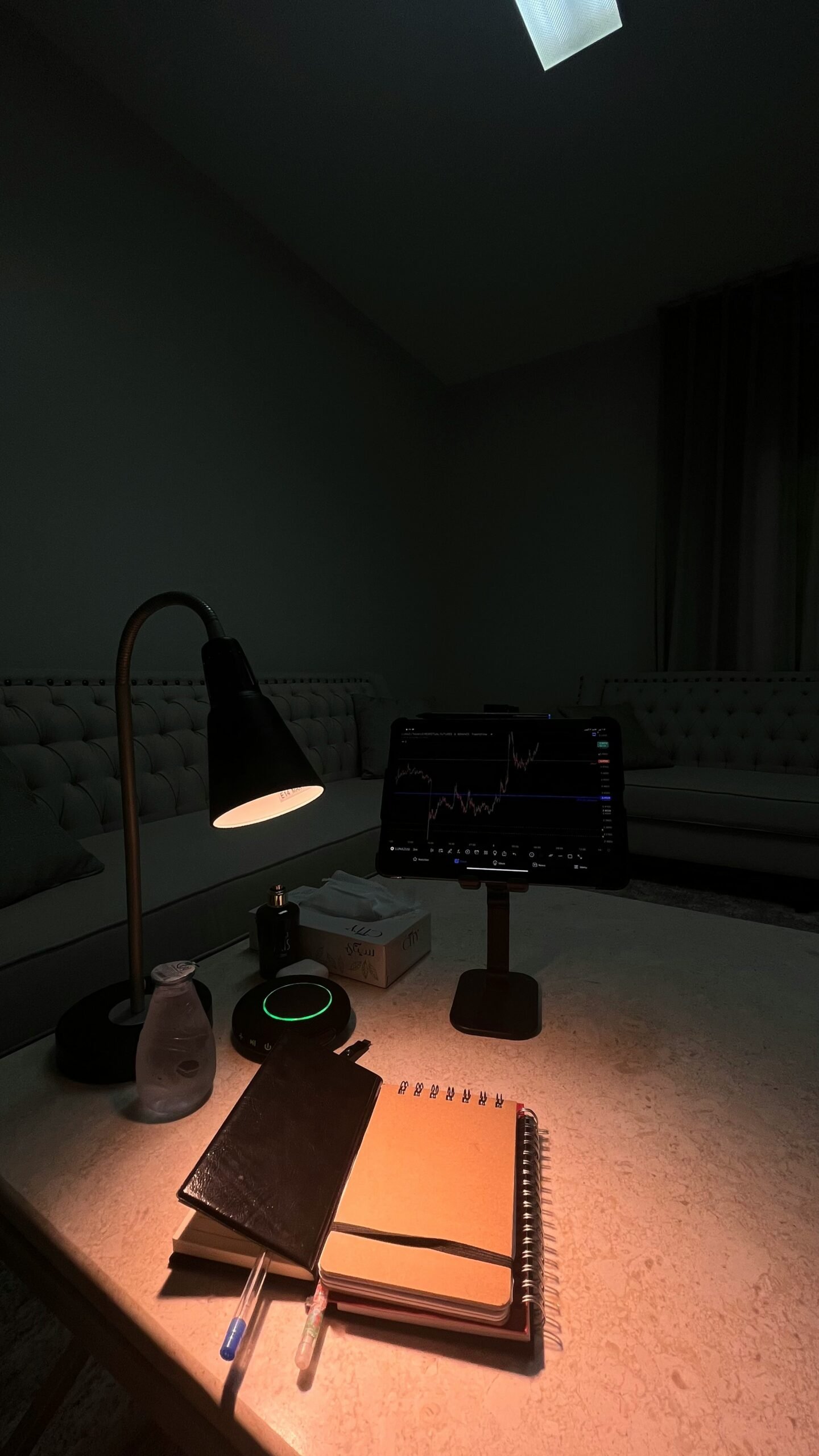

When embarking on your journey in Forex trading, understanding essential strategies and tools is an absolute necessity. Proper introduction to fundamental elements like technical analysis, charting tools, and common trading strategies can significantly influence your trading performance and outcomes.

Technical analysis is a key strategy in Forex trading. It involves studying historical price movements and using this data to forecast future price changes. Charting tools play an integral role in this analysis. Traders often rely on different types of charts, such as candlestick charts, line charts, and bar charts, to visualize price movements over specific periods.

Among the pivotal strategies in Forex trading is trend following. This strategy revolves around identifying and complying with the direction of the market trend. By placing trades that align with the prevailing trend, traders can increase the likelihood of success. Tools like moving averages and trend lines are commonly used to recognize and confirm these trends.

Another widely employed strategy is breakout trading. This involves identifying key levels of support and resistance on a chart and placing trades when the price breaks through these levels. Breakout trading can be advantageous because it often signals the beginning of a new trend, thereby providing an opportunity for significant profits.

Risk management is an indispensable component of any trading strategy. Effective risk management techniques include setting stop-loss and take-profit orders. A stop-loss order helps to limit potential losses by automatically closing a trade when the price reaches a pre-determined level. Conversely, a take-profit order helps to secure gains by closing a trade once the price achieves a specified profit target. Both tools are essential for protecting your capital and ensuring consistent trading discipline.

In summary, integrating these fundamental Forex trading strategies and tools into your trading plan can help you navigate the complexities of the Forex market more effectively, thereby enhancing your potential for success in this dynamic trading environment.

Common Mistakes and How to Avoid Them

Forex trading can be a lucrative endeavor but is fraught with pitfalls that can trap even the most well-meaning beginners. Understanding and avoiding these common mistakes can significantly enhance a trader’s chances of success.

One of the most frequent errors is over-leveraging. Leverage in Forex trading allows traders to control larger positions with a relatively small amount of capital. While this can amplify profits, it also magnifies losses. Beginners are often tempted by the prospect of high returns and, unfortunately, end up risking more than they can afford to lose. To avoid over-leveraging, it is crucial to manage risk diligently and use leverage wisely. Setting appropriate stop-loss orders can also help in mitigating potential losses.

Emotional trading is another common mistake that can derail a trader’s strategy. It’s easy to let emotions like fear and greed influence trading decisions, leading to impulsive actions and significant losses. Developing discipline is essential in Forex trading. Sticking to a well-defined trading plan and maintaining a calm demeanor, irrespective of market conditions, can help traders make rational decisions instead of emotional reactions.

Lack of a solid trading plan is a critical oversight. A comprehensive trading plan outlines your goals, risk tolerance, market analysis, and specific entry and exit points. It serves as a roadmap, helping traders stay on course. Without a concrete plan, traders are likely to take inconsistent actions, making it hard to evaluate performance or improve strategies. Investing time in creating a detailed trading plan and adhering to it can provide structure and clarity.

Lastly, the importance of continuous learning and adaptation cannot be overstated. The Forex market is dynamic and constantly evolving. Traders need to keep abreast of market news, economic indicators, and new trading strategies. Engaging in regular education, such as reading books, attending webinars, and participating in trading forums, can provide valuable insights and enhance trading skills. Adapting to market changes and consistently improving one’s knowledge base are pivotal for long-term success.

By recognizing and addressing these common mistakes, beginners can cultivate good trading habits from the start, setting the foundation for a successful Forex trading career.